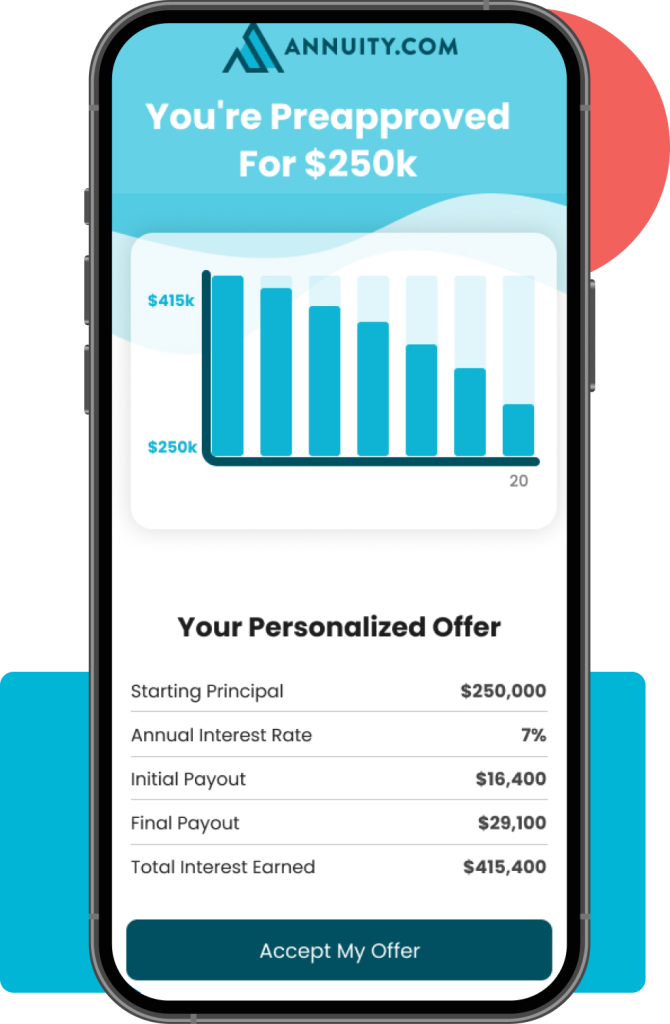

Grow your retirement with the guarantee of an annuity. Annuity.com is committed to transparency and personalized service to help you meet your retirement goals

And for good reason: annuities offer a unique combination of stability, flexibility, and guaranteed income that make them an unparalleled retirement product. Both fixed and indexed annuities provide a reliable solution for retirement income—one that never loses value from market volatility.

Without the expertise of a licensed insurance producer, decisions regarding annuities can be difficult to make. We can help you feel confident in choosing the right annuity for your retirement strategy.

Our annuity experts give you clear and transparent retirement guidance that just makes sense. Equipped with our personalized assistance, you can make an informed decision on what product works for you and your financial strategy.

Annuity.com offers only licensed agents with the expertise necessary to help you make the right financial decisions for your needs. Our agents don’t work for any other provider, so they can be unbiased and make sure you get the product that suits your needs. We promise to provide this and more.

To get you the best annuity, we draw from 65+ annuity providers. Apply once, then choose the right option for you.

We streamlined the process to help you find out which options are right for you in mere minutes.

Work with an agent that has your needs and concerns in mind. We’ve helped thousands of people secure their retirement!

John has been so helpful in answering all our questions and meeting with us multiple times to help us decide which company to go with. We have been very impressed with his knowledge, and always having our needs at the forefront. We highly recommend John for all your Annuity questions. He will treat you like family and recommend the best policy for you.

One year with Us

Annuities are a great option for retirement planning as they can provide both a steady income for life and tax benefits, while minimizing one’s exposure to market risk.

Unlock the full potential of your retirement planning with our detailed annuities guide. Learn how annuities can provide a steady income stream, reduce financial risks, and ensure you enjoy a comfortable retirement. Start securing your financial future today!

© Years of Copyright Publication 2015–2025 All rights reserved. Subject to the provisions of this notice, articles, materials and content published on this site (Annuity.com) are the property of Annuity.com, Inc. Annuity.com, Inc. allows the use of their content but reserves the right to withdraw permission at any time. Content includes articles, marketing materials, agent information used as content on all pages. Content used by Annuity.com as information for the public, enhancement of any agents reputation and lead generation for all sources is copyrighted.