Why should you care about the “time value of money?”

One of the fundamental financial concepts, the time value of money (TVM), says that the current value of a sum of money is worth more than the future value of that same amount. The principle of TVM comes from implicit costs, known as “opportunity costs.” It would be best if you evaluated when deciding whether it’s better to receive money now or take payments in the future. One way to think about opportunity costs is that they represent the value of what you stand to lose or possibly miss out on when you choose one possibility over another.

For example, a favorite uncle left you $100,000 in his will with the option to either take the whole sum now or get the money in equal payments over three years and receive an additional $500.00 for doing so.

For most of us, the instinctive choice is to take all the money right now and not wait three years to put it to use. By taking that money immediately, you can put it into an account that offers you continuous compounding interest that is likely to equal or exceed the $500.00 bonus you get for waiting. You could invest in an appreciating asset such as real estate or a cash-flowing business when you get the money right away. You might purchase stock with the potential to gain value or lock-in value with an annuity or life insurance policy. Because it provides immediate purchasing power, most people consider a present-day sum of money more valuable than a future sum.

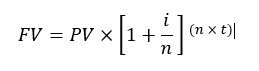

Understanding the theory of the time value of money can help you avoid making costly mistakes with your money. You may one day face the decision to take a lump sum of money immediately or wait until later. Fortunately, there is an easy formula for the time value of money that takes the guesswork out of the decision. In this formula, the following variables are accounted for:

- FV= Future value of money

- PV= Present value of money

- i=interest rate

- n= number of compounding periods per year

- t= number of years

Using the TVM formula, we can determine whether it would be wiser to accept the $100,000 from your uncle as a lump sum or in equal annual payments over three years along with the additional $500.

We have established that by not taking the lump sum, you stand to gain an additional $500. The question is, how much money could you earn over the three years if you were to receive the $100,000 and invest it today? Let’s say you take your $100,000 and invest it in a fund with an average annual rate of return of 6%. You want to know how much your investment will grow by the 3rd year. To figure this out, input the variables, and you will be left with the future value of your investment for a particular year.

119,101.60=100,000 x (1+.06)3

As you can see, after the 3rd year, your initial investment will have earned you an additional $19,101.60. Now that you know, taking the lump sum seems like a no-brainer.

If you are taking an active approach towards investing for retirement or other financial goals, do not be fooled by the allure of “free” money in return for splitting the sum into smaller payments. Carefully evaluate the pros and cons of each option while keeping in mind your own financial goals. Use the TVM formula, compare the potential gains and remember this; a dollar today is worth more than a dollar in the future.

SD, LC