I frequently ask clients during our first conversation, “what is the average return of the market?”

Usually, without fail, they answer, “7% – 8%.” My next question is, “when has it averaged that return?” Usually, without fail, they answer, “historically,” or something to that nature. My response to this answer is, “do you think it’s wise to use the average over 100 years, and do you think it’s wise to use an average return at all?” This is typically met with some confusion, so let me explain further. You see, based on average returns, I can make the market look great, or I can make it look horrible.

There is a difference between average returns vs. actual returns. Here’s an example: If I were to start my own investment company and I promised you a 25% average return, would you at least be interested to hear more about it? Absolutely – with some healthy skepticism! But if I could get you an average return of 25%, or even 8%, you would tell everyone you know about it!

Let me introduce you to “Wall Street Math.”

If I double your money the first year, then lose half, then double it, then lose half, I have technically upheld my end of the agreement. I achieved an average return of 25% interest, but your actual performance was zero! Not to mention that you’re four years further down the road, and we haven’t even talked about fees or taxes yet.

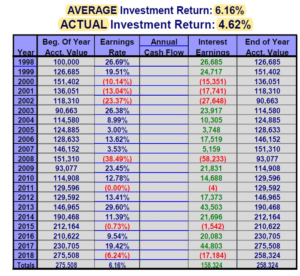

Let’s put this same test to the S&P 500 Stock Index. We’re looking at the S&P 500 without dividends, but we’re assuming no management fees, which will typically cancel out the dividend growth. Looking back 20 years, the S&P 500 has averaged 6.16%. Not bad! But what is the actual return? See for yourself.

You may be thinking, “Hey, in this environment, that’s still not bad!” So, what’s my point?

My point is that it is a far cry from the 7%-8% actual return that most people believe they are going to earn with their retirement funds. My point is the next time your “money guy” tells you what he has averaged for his clients, you need to ask what the actual returns have been. My point is if this is the ‘best of the best’ when it comes to indexes, and you cannot keep all of your retirement money in equities because of the Sequence of Returns Risk, what can you expect to earn on your money in retirement?

The reality is with the ‘traditional retirement plan’ of stocks, bonds, and mutual funds, nobody knows! But there is one industry that has been protecting people’s money for well over 100 years. It’s the insurance/annuity industry, and with the help of an expert, you can know what you will have for the rest of your life, with no market risk!