When it comes to Medicare, do you get confused about the details? Not only do you need to know all of the different parts of the program, you must also be aware of the penalties that can be assessed if you join late. Now there is a surcharge if you make too much money, you heard that correctly. In December 2003, Congress passed the Medicare Modernization Act of 2003, Section 1839(i) allowed Congress to create a surcharge for those who are high-income earners that will be attached to their Part B and Part D premiums. The new rules from the Medicare Modernized Act of 2003 took effect on January 1, 2007. One of the biggest parts of it was the Income Related Monthly Adjusted Amount (IRMAA). These new rules allowed the IRS to review individuals’ income tax returns from two years prior to obtaining Medicare benefits. The IRS would use a modified adjusted gross income as the standard to see if the individual is within the subsidy for Part B and Part D. The further outside the threshold, the less subsidy that person is entitled to receive.

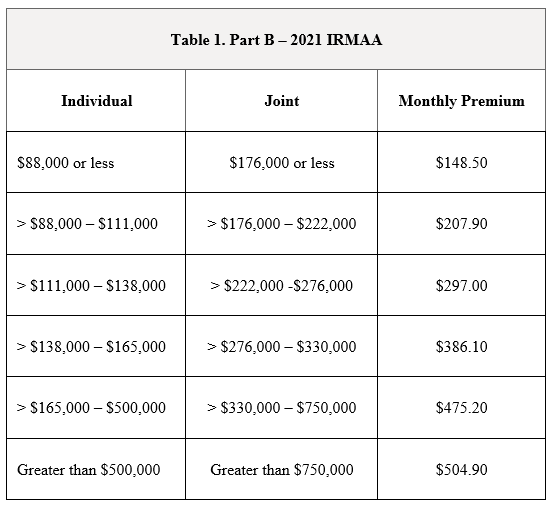

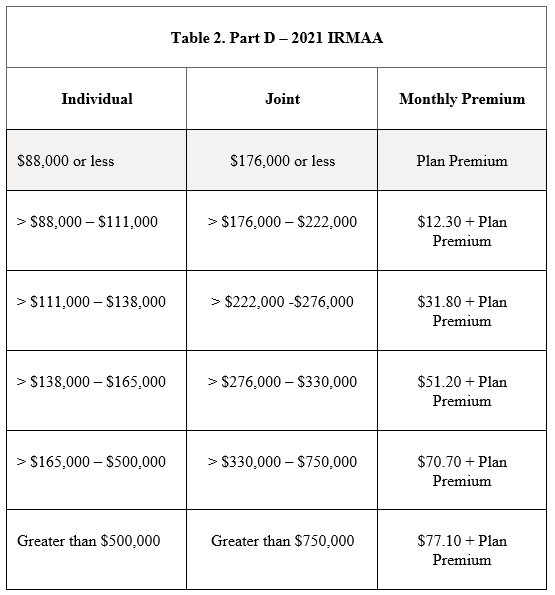

What does this all mean to someone who is about to retire? If a person plans to retire in 2022, the IRS will look at their 2020 income taxes. If their modified gross adjusted amount is under $88,000 if single, or $176,000 for a married couple, they would not be assessed an IRMMA charge. They will pay for their Part B at the base rate of $148.50 per month. The price for Part D would simply be the plan’s premium. In the event that the adjusted gross amount is greater than in this example, it could result in losing some of the Part B subsidy when Social Security assessed an IRMMA charge. Private companies manage Medicare Part D, and as such, Social Security does not have the same financial control as Part B; Part D IRMAA assessment is stacked on top of the monthly premium. The following chart is based on 2021 IRMAA and is based on 2019 tax returns.

Source: CMS

Source: CMS

If this were to happen, could you appeal the decision? The answer is, of course, there are a couple of things to remember, the government is fast to take a fee but slow to return it, and Social Security is the one that has the final decision. Here are some reasons you could be eligible for an appeal. Please note this is not all-inclusive and doesn’t guarantee a successful outcome.

- Death of spouse

- Marriage

- Divorce or annulment

- Work reduction

- Work stoppage

- Loss of income from income-producing property

- Loss or reduction of certain kinds of pension income

Not everything on the tax return is included in the modified adjusted gross income amount. This would be a great opportunity to speak with a financial advisor to assist you in planning correctly and ensure you keep the money you have saved for retirement. There are many factors that everyone needs to take into consideration when planning for retirement, so plan early and review it often. Some questions to consider are:

- At what age should I retire?

- At what age should I start taking out my 401/403b/457 distributions?

- When shall I sell my business?

- What about my stock and bond options?

Improper planning could have hundreds if not hundreds of thousands transferred into the bank account and waiting to be claimed as income at the end of the year.

The author has provided links to further reading into the Medicare Modernization Act of 2003. Forbes had a great article about Medicare and the fear of it going broke that talks a little about the Act of 2003 and how the law could help Medicare in the long run.

Further reading:

FORBES.com: No, Medicare Won’t Go Broke In 2026. Yes, It Will Cost A Lot More Money (forbes.com)