I’d like to start this article by saying, if you’re in your mid to late 60s, you may not have the time to utilize the living benefits of this concept. However, if you’re still in your late 50s to early 60s, you may be able to use this concept to supplement some of all of your retirement income!

Whole life insurance has been around for over 200 years. When you buy a policy from a mutual insurance company, part of your premium becomes cash value, and you incur guaranteed interest. You also incur non-guaranteed annual dividends, which have been paid faithfully for over 100 years, I might add. As time goes by, your cash value grows to give you more and more access to your death benefit while you’re living! When you need to access the money, you’ll take a simple interest loan against your cash value. It’s a simple form with a 3 to 5 business day processing time. There is no credit check, and the money is guaranteed. You determine the terms of repayment, and any interest paid over the minimum goes directly into your policy.

When these policies are structured for maximum cash value, you can break even as early as five years into the policy. That means that any money put into the policy beyond this point will actually be making more money for you! This leverage can be used to buy equipment, real estate, vehicles, pay down high-interest debt, and yes, provide a tax-free income stream for retirement.

Assuming you have investments, annuities, etc. Wouldn’t you want to let those accounts continue to grow as long as possible tax-deferred? Of course, you would! Also, wouldn’t you want to leave the largest inheritance to your heirs as possible? Again, this is an oxymoron! A maximum cash-value life insurance policy can help you accomplish those exact goals. Teach this concept to your loved ones, and it becomes even more powerful.

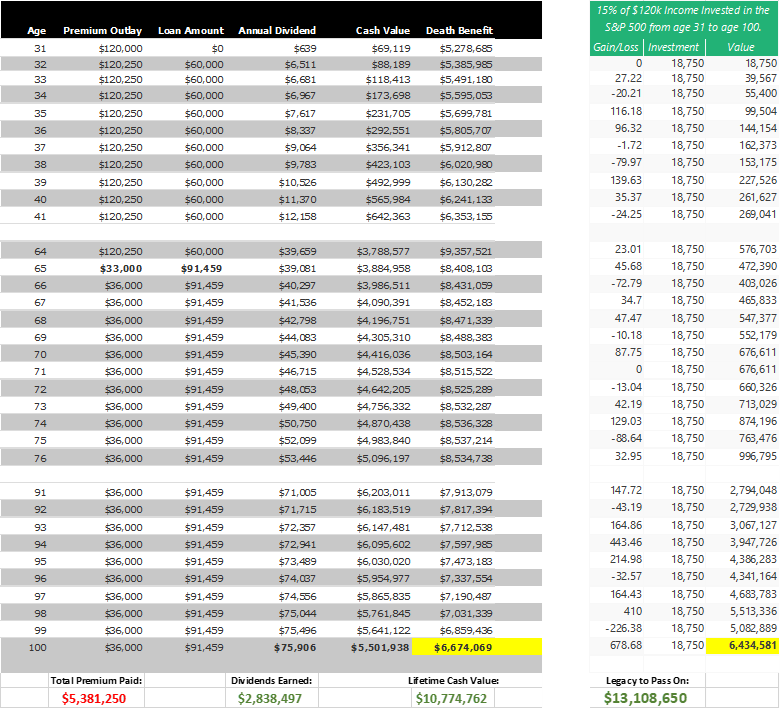

Below is an example of a 31-year-old who uses this concept as a savings and cashflow tool in addition to his traditional investments. As you’ll see, he does quite well by age 65. Always consult with a licensed Life Insurance Agent before purchasing a policy of this type. It must be structured a certain way to benefit you as a consumer. Whole Life Insurance, when appropriately used, can be a powerful asset in your retirement plan!

In the above example, John makes $120k per year and has a monthly budget of $5,000. At age 31, John moves his 6-month emergency fund and half of his income into a joint banking policy with his wife. (Her income is not included in this example.) The following year John begins to cash flow his entire income through his policy, borrowing against it for his monthly expenses. By doing this, John generates a $91,459 tax-free income for retirement by age 65. Even if John lives to be 100 years old, he will leave his family with over $6.67 Million more dollars than he would by simply investing 15% of his income traditionally. John’s traditional investments will also grow much larger, enabling him to save. He can now leave his family 13 million dollars. This is just one example of the power of the Infinite Banking Concept.