Conjecture: the formation or expression of an opinion or theory without sufficient evidence or proof

I want you to absorb that definition because “financial conjecture” is a dangerous thing. Not only is it a dangerous thing when you accept financial conjecture from family or friends, but what about when it’s from a nationally recognized “financial expert.” A recent article has caused a big stir in the world of annuity professionals. I won’t mention the person’s name, but he has a history of spreading half-truths about my profession and my products. The majority of his arguments are in direct relation to Variable Annuities, which are loaded with fees, have a lower payout rate than Fixed Indexed Annuities, and can lose your money in a market downturn. I do not recommend these products, and you should exercise great caution if you are considering them. Whether he is spreading these half-truths on purpose or out of pure ignorance, it is still wrong. Most likely, it’s just a marketing ploy to scare people out of guaranteed income products and get them back into the world of speculation and high fees.

There have already been several intelligent rebuttals in regards to his recent interview from USA Today. I have provided the links below to his interview and several responses from leaders in our industry.

https://nafa.com/re-why-i-still-hate-annuities-here-are-the-reasons-these-investments-are-bogus/

These are well thought out responses, but the devil is in the details. The devil lives in the dark, and nothing shines a light on financial darkness like math. Let’s jump out of the world of speculation and negative marketing so we can see what the numbers have to say.

Let’s say we’re looking at a straight Fixed Indexed Annuity that is designed strictly for growth, with NO income rider, and has an 85% Participation Rate (the insurance company will give you 85% of the growth of your chosen index). We then compare that to another investment that will provide you with 100% of the return but will also give you 100% of the risk. And, don’t forget you also get to pay fees for the privilege of carrying all of the risks.

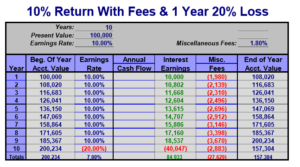

I happen to know, from a former client of this gentleman, that he was being charged 1.8% annual fees for doing business with his firm. So, just to keep the comparison simple, let’s say you invest $100,000, and your return is 10% per year. But you’re paying a 1.8% fee, and you have a 20% loss one year because of a market downturn.

At the end of ten years, your $100,000 would look like this.

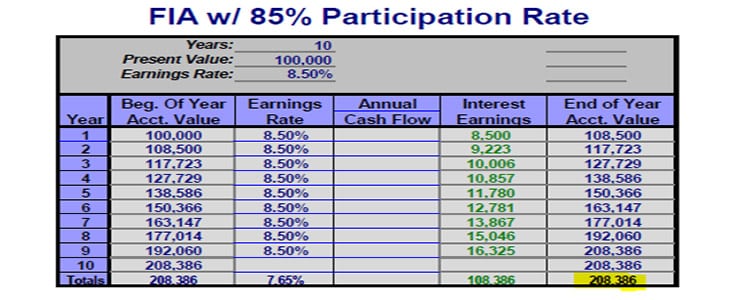

Now, let’s compare the Fixed Indexed Annuity that is designed strictly for growth, has no fees, no risk of loss, and an 85% Participation Rate. At the end of ten years, your $100,000 would look like this.

Maybe the first thing you noticed was that your ending balance was over $50,000 MORE than the investment where you kept 100% of the return, but also assumed 100% of the risk. I’m sure you also noticed that the fees that were paid directly out of your pocket were almost $28,000!

Considering the gentleman in the above interview constantly feels the need to bloviate about the fact that we make a commission, I think it especially important in this article to point out the fact that we are paid directly from the insurance company’s general fund, not from you. Also, you will see that he still charges a fee even in the year where he lost your money. Which scenario seems fair to you???

As a wise man once said, “You can fool some of the people all of the time. You can fool all of the people some of the time. But you cannot fool ALL of the people ALL of the time.”

Thankfully people are starting to wake up and challenge the conventional wisdom of mainstream financial marketing. As always, if you would like to learn how a Fixed Indexed Annuity can work for you and your goals, you can contact any one of the fantastic authors at Annuity.com.